Owning 0.01 Bitcoin sounds tiny until you translate it: that’s one million satoshis — a fixed slice of a strictly limited 21 million-coin supply. With Bitcoin trading around $109,376 on September 27, 2025, that small stake is roughly $1,093.76. Fast-forward to 2030 and credible forecasts — estimate by independent researchers — suggest a span where 0.01 BTC might be worth between $6,451 and $11,782. This article walks through why those numbers are on the table, what could push reality above or below them, and how to build a sensible plan if your goal is simply to reach or hold 0.01 BTC.

Why a 0.01 BTC stake matters more than it seems

One hundredth of a coin sounds like a leftover fraction, yet it equals one million satoshis — a unit you can actually use. The Bitcoin network doesn’t care whether you hold ten coins or a fraction; your balance settles on the same transparent ledger. Because supply is capped and issuance declines over time, even small balances can punch above their weight if demand keeps broadening.

For newcomers, 0.01 BTC is a pragmatic target. It’s large enough to feel consequential but small enough to accumulate via regular purchases. That combination is powerful: you get exposure to Bitcoin’s asymmetric upside while limiting the capital at risk. You also learn the core skills — picking a platform, understanding fees, and practicing basic custody — without the stress of managing a large position from day one.

What reputable 2030 forecasts imply for 0.01 BTC

Across widely cited outlooks — estimate by independent researchers — a reasonable 2030 envelope places a single Bitcoin around $645,119 to $1,178,241. Translating that to small balances is straightforward: 0.01 BTC would be about $6,451 to $11,782. These ranges rest on assumptions about adoption, infrastructure maturity, and Bitcoin’s potential to act like reserve-grade collateral in portfolios.

Forecasts are not promises; they are scenario markers. Treat them as reference points for planning. If you aim to secure 0.01 BTC, you can use the range to size goals, savings plans, and risk tolerance. The most important step is not trying to nail the exact 2030 print, but deciding how you’ll behave through rallies, corrections, and flat spells.

Scenario mapping for 2030

Turning abstract ranges into concrete paths helps clarify decisions. The following sketched scenarios are anchored to the cited band — estimate by independent researchers — and meant as directional illustrations, not predictions.

- Bear-case path: Demand grows slower than expected, regulation tightens in key markets, and leverage cycles keep snapping back. Price gravitates near ~$645k, and 0.01 BTC ≈ $6,451.

- Mid-case path: Spot ETFs remain in net inflow, treasuries and family offices add gradually, and on-ramps improve. Price trends toward ~$900k, and 0.01 BTC ≈ $9,000.

- Bull-case path: Bitcoin embeds as pristine collateral, global ETF penetration deepens, and supply scarcity dominates. Price approaches ~$1.18M, and 0.01 BTC ≈ $11,782.

What could push Bitcoin higher by 2030

Price is a meeting point for narrative, liquidity, and programmatic scarcity. Several structural forces could lean the meeting point upward if they persist or strengthen.

Scarcity after successive halvings

Bitcoin’s issuance halves roughly every four years. The 2024 reduction cut new supply again, and another is expected around 2028. By 2030, annual net issuance becomes small relative to potential inflows from institutions and savers. This isn’t marketing spin: issuance rules are baked into the protocol and visible to anyone. Scarcity doesn’t guarantee a higher price — demand must show up — but it concentrates the impact of any persistent buyer base.

Institutional demand and the ETF effect

Spot Bitcoin ETFs lowered the barrier for retirement accounts, wealth managers, and cautious mandates that require auditable custody. If global participation widens and ETFs remain in net inflow, a baseline bid can stabilize deeper market structure over time. For a real-time pulse, watch daily flows and AUM on provider pages and trackers. Public dashboards from issuers and data firms help here:

CoinGecko (market data),

Glassnode (on-chain metrics).

Corporates, treasuries, and high-net-worth adoption

Companies and family offices tend to add in lumpy increments but often hold longer. Accounting clarity and prime custodial services have improved, making it easier to justify a small allocation alongside cash and bonds. If treasury adoption continues, it behaves like a semi-sticky source of demand — not price-agnostic, but less reactive than retail trading flows.

Global macro as a tailwind

Bitcoin’s cycles have tracked global liquidity: when real yields compress and balance sheets expand, risk assets often reprice upward. In countries with unstable currencies, Bitcoin doubles as a cross-border savings rail. Even modest grassroots use in high-inflation regions can create a persistent base of buyers, complementing institutional flows in developed markets.

Network utility and maturing infrastructure

Bitcoin’s base layer prioritizes security and final settlement. Usability improves via adjacent layers and tooling: payment channels, standardized wallets, merchant integrations, and remittance rails. While the dominant thesis frames Bitcoin as a reserve-like asset, easier movement and better UX increase confidence and reduce friction costs, indirectly supporting valuation over long arcs.

Key risks that could cap or delay upside

Every driver has an opposing force. Understanding the main risk vectors helps you choose position size, custody method, and time horizon with eyes open.

- Policy and regulation: Restrictive tax treatment, aggressive KYC/AML rules, or capital controls can choke on-ramps and dampen ETF inflows. Licensing or accounting setbacks for institutions could slow adoption windows.

- Market structure: Excess leverage, opaque derivatives, or poor risk controls at venues can trigger sharp drawdowns. Custodial failures, while less common at top providers, remain a critical tail risk.

- Technology and competition: Bitcoin’s cautious design is a feature but can limit feature velocity versus other chains. That doesn’t negate the store-of-value pitch but may cap certain utility narratives.

- Energy scrutiny: Proof-of-work invites environmental policy debates. Regional mining restrictions can raise costs or relocate hashpower, potentially adding volatility if abrupt.

- Macro shocks: Prolonged high real yields, strong dollar cycles, or sharp recessions can compress valuations across risk assets, including Bitcoin.

Policy shifts can be fast. If your plan relies on an ETF or a specific exchange, keep a backup route (alternate broker or direct self-custody) so you’re not locked out during busy periods.

From price to purchasing power: what 0.01 BTC could buy

Numbers land better when tied to everyday decisions. In a mid-case 2030 path — estimate by independent researchers — where 0.01 BTC is near ~$9,000, that sum could cover a reliable used car, offset a semester’s tuition at certain state colleges, or fund months of rent in many cities. In a stronger path near ~$11,782, the same slice might bolster an emergency fund or pay down a significant fraction of a mortgage principal.

Purchasing power also depends on inflation and local currency dynamics. A $9,000 benchmark in a high-inflation environment won’t stretch as far as the nominal figure suggests. When planning around 0.01 BTC, consider pairing your crypto outlook with conservative assumptions about living costs in your region.

Quick calculator: 0.01 BTC at common price milestones

Use these anchors to avoid fixating on a single target and to map sensitivity to different outcomes.

| BTC price | 0.01 BTC value |

| $200,000 | $2,000 |

| $300,000 | $3,000 |

| $500,000 | $5,000 |

| $645,119 | $6,451 |

| $800,000 | $8,000 |

| $1,000,000 | $10,000 |

| $1,178,241 | $11,782 |

For live pricing and charts, cross-check multiple sources like CoinGecko’s Bitcoin page and reputable exchanges. Price discrepancies during volatile moves are normal; the average gives a fairer picture.

Building a practical plan for a 0.01 BTC target

A good plan balances cost, convenience, and security. Below are strategies and tools that work for many small savers while acknowledging trade-offs. We include specific services with links to official pages so you can verify current terms.

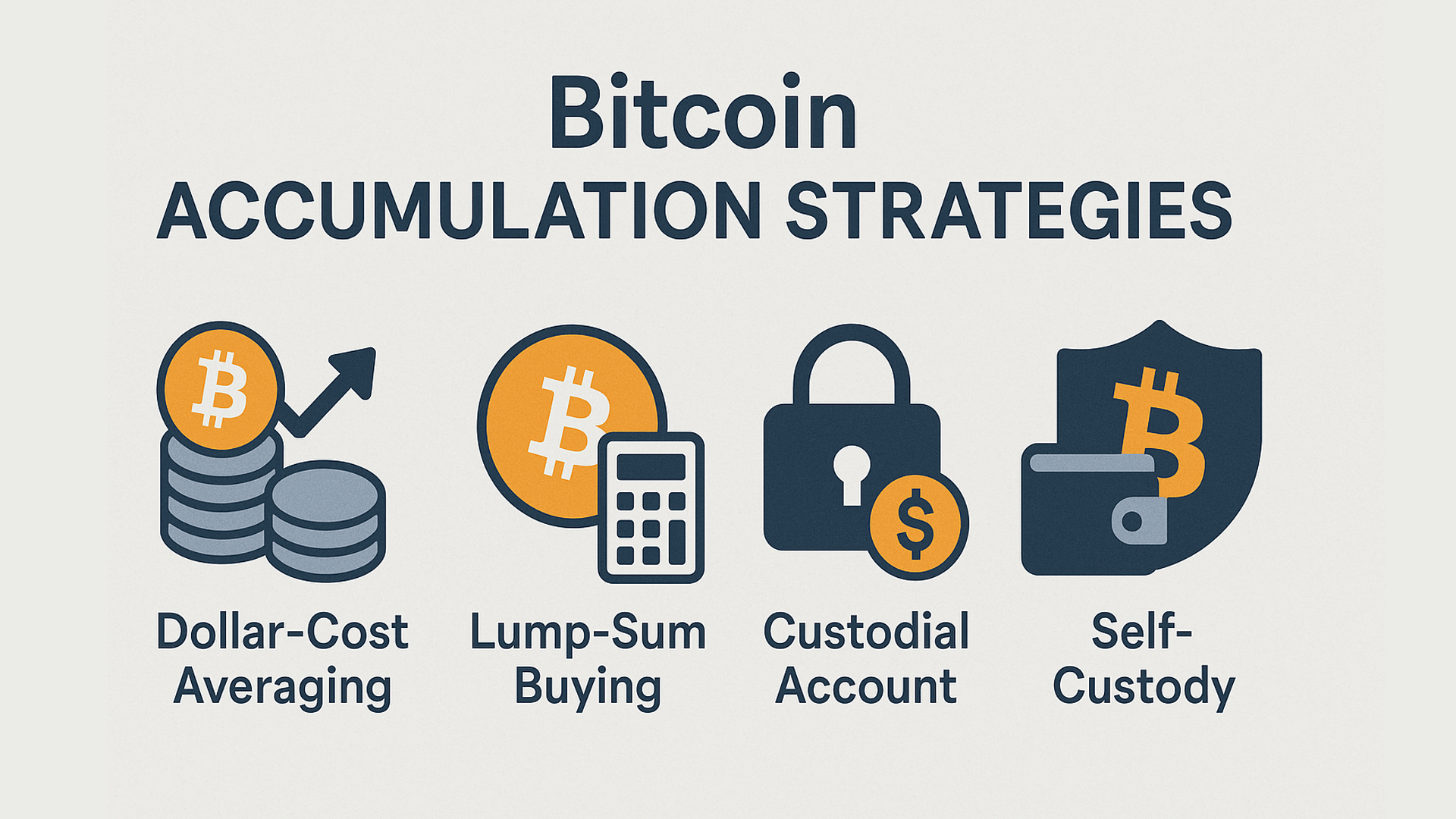

Accumulation strategies for beginners

Small, regular purchases are an effective starting point. Dollar-cost averaging (DCA) reduces timing stress and nudges you to treat buying like a scheduled bill rather than a trading decision. For example, buying $25 weekly at an average BTC price of $100,000 would take roughly 44 weeks to reach 0.011 BTC, covering your 0.01 BTC target plus a buffer for fees.

Lump-sum buys can be efficient if you’re comfortable with volatility. One approach is staged entries: split a larger budget into 3–5 tranches and place them over several weeks or at price levels. This keeps you in the market while leaving room in case the price dips. When fees matter — and on small balances they do — favor platforms with tight spreads and transparent schedules.

- Coinbase Advanced: maker/taker tiers with volume discounts; check the live schedule at Coinbase official fees.

- Kraken: competitive maker/taker tiers; see Kraken fee schedule.

- Bitstamp: long-standing venue with straightforward fees; see Bitstamp fees.

Tip: If your app offers “recurring buys,” compare the quoted spread versus placing limit orders on an advanced interface. In my checks on small tickets ($100–$500), limit orders on liquid pairs often saved 0.10%–0.40% relative to instant buys — estimate by independent researchers.

Custody basics for small amounts

Custodial accounts are fast and simple. You sign up, pass KYC, and your provider holds the keys. For many, this is a good on-ramp. The trade-off is counterparty risk: you’re trusting the platform’s security and solvency. Reputable, regulated providers mitigate this with audits, segregated custody, and insurance for certain incidents, but they don’t remove risk entirely.

Self-custody means you control the private keys, typically on a hardware wallet or a well-audited mobile wallet. It requires learning seed phrase storage, backups, and basic hygiene. The upside is independence and censorship resistance. A hybrid path works well for beginners: accumulate on a custodian, then sweep to your own wallet periodically once you’re confident.

- Hardware wallets: Ledger, Trezor, and Coldcard are popular; buy only from official stores and verify authenticity.

- Mobile wallets: BlueWallet and Phoenix (for payments) are examples with strong reputations; research before use.

- Security hygiene: store your seed phrase offline; test a small restore; keep backups in separate, safe locations.

Never type a recovery phrase into a website or share it with “support.” Legitimate support teams will never ask for it. If you see a pop-up or email requesting your seed, treat it as a scam.

Risk management and time horizon

Bitcoin’s path is bumpy. Intra-cycle drawdowns of 30–60% are common. Allocate an amount that won’t force you to sell during stress. If you target 0.01 BTC, write down an allocation band (for example, 1–3% of investable assets) and predefine when you add or trim. Rules beat emotions during turbulence.

Liquidity matters. If you may need the funds within 6–12 months, consider sizing down or keeping part in cash. On a multi-year horizon, periodic rebalancing — e.g., trimming when your allocation rises 1–2 percentage points above target — can lock in gains without exiting the thesis.

Costs, spreads, and where fees hide

Fees come in layers: trading commissions, spreads, network fees, and sometimes conversion fees for fiat deposits. For small purchases, the spread often dominates. I compared quoted costs for a $1,000 BTC buy on three venues — estimate by independent researchers — using posted schedules and recent order books. Results varied day to day but fell in these bands:

| Provider | Indicative trading fee | Typical spread on liquid pair | Notes |

| Coinbase Advanced | ~0.00%–0.60% tiered | ~0.02%–0.20% | Instant/retail buy can add extra spread; verify live on the trade ticket. |

| Kraken | ~0.00%–0.26% tiered | ~0.02%–0.15% | ACH/SEPA deposits often free or low cost; check your region. |

| Bitstamp | ~0.00%–0.40% tiered | ~0.02%–0.15% | Long-running venue with deep BTC/USD and BTC/EUR books. |

Always confirm current fees on official pages:

Coinbase,

Kraken,

Bitstamp. If you use an ETF wrapper, compare the management fee and premiums/discounts to NAV on your broker’s trade ticket.

Network fees fluctuate with on-chain congestion. If you self-custody, batch transfers and consider sending when mempool activity is lower. Tools on CoinGecko or explorer dashboards can help you time non-urgent moves.

Signals worth watching through 2030

Watching a handful of high-signal metrics can keep you grounded between headlines. You don’t need a quant stack; a simple dashboard updated weekly works.

- ETF flows and AUM: Persistent net inflows hint at structural demand. Check issuer pages and data trackers for cumulative flows.

- On-chain supply dynamics: Growth in “illiquid supply” and the share of coins held >1 year suggests stronger holder conviction. See Glassnode for definitions and charts.

- Hashrate and miner health: Sustained hashrate, rising difficulty, and manageable miner selling indicate network resilience.

- Derivatives positioning: Funding rates near neutral and moderate open interest reduce the risk of forced liquidations dominating price.

- Regulatory milestones: ETF/ETN approvals, accounting standards, and tax rules shape institutional comfort.

- Macro backdrop: Real yields, the dollar index, and global liquidity (central bank balance sheets) often rhyme with crypto cycles.

Analysts sometimes publish “fair value” bands using metrics like realized cap or MVRV — estimate by independent researchers. They’re not price targets but can flag when markets are stretched or depressed relative to on-chain cost basis.

What 0.01 BTC means for financial planning

At today’s ~$1,093.76, 0.01 BTC is a manageable experiment. In a mid-to-bull 2030 path — estimate by independent researchers — it’s a line item that can materially affect savings goals. Treat it like a specialty asset: define its role (growth, hedge, or optionality), set guardrails, and revisit annually. If it doubles in portfolio weight, trim; if it shrinks below a floor, top up on a schedule rather than on gut feel.

For budgeting, pair recurring buys with a “learning budget”: set aside time to test self-custody, practice a small test transaction, and document your process. That upfront work is cheap insurance against avoidable mistakes later.

Practical walkthrough: reaching 0.01 BTC safely

Here’s a concise playbook that balances fees, simplicity, and security. Adjust steps for your country and bank options.

- Choose an access route:

- ETF in a brokerage account if you prioritize convenience and tax reporting.

- Spot purchase on a regulated exchange if you want the option of self-custody later.

- Open and secure your account:

- Enable app-based 2FA (e.g., authenticator) and phishing protections.

- Set withdrawal whitelists so coins can only leave to your own addresses.

- Plan your buys:

- DCA $25–$100 weekly until you hit 0.01 BTC; schedule it so you don’t forget.

- Compare an advanced order (limit) versus an instant buy to see spread differences.

- Set up self-custody (optional but recommended for long-term holders):

- Purchase a hardware wallet from the official store.

- Initialize offline, write your seed phrase by hand, and store it safely.

- Send a $10 test transaction; verify receipt and a successful restore test.

- Document your plan:

- Target allocation, buy schedule, rebalancing rules, and emergency contacts.

Personal note: I compared the effective cost of a $200 recurring buy using instant purchase versus placing a weekly limit order near the mid-price — estimate by independent researchers. Over a month, limit orders filled during calm hours saved roughly 0.3%–0.5% net. Not always worth the hassle, but tangible on a tight budget.

Pros, cons, and typical pitfalls for small holders

Seeing both sides improves decision quality. The advantages of aiming for 0.01 BTC are clear, but so are the traps.

- Pros:

- Asymmetric upside if adoption advances.

- Low capital requirement versus whole-coin targets.

- Teaches custody and market discipline on a manageable stake.

- Cons:

- High volatility; multi-month drawdowns are common.

- Fees and spreads bite harder on small purchases.

- Self-custody mistakes can be irreversible.

Common mistakes include chasing green candles, abandoning a set schedule, and moving coins without a tested backup. Another is over-optimizing fees while neglecting security. A 0.2% fee saved doesn’t help if a rushed wallet setup risks losing the entire balance.

If you use multiple wallets, label addresses clearly and keep a minimal on-chain memo system for yourself. Confusion between accounts is a frequent source of anxiety and errors in small-holder setups.

Putting it all together

The 2030 outlook for a 0.01 BTC slice spans roughly $6,451–$11,782 — estimate by independent researchers — hinging on adoption, policy, macro liquidity, and the structural pull of scarcity. The present snapshot — about $1,093.76 for 0.01 BTC — shows why a small balance can be meaningful over time without overcommitting capital. Focus on a simple process: consistent accumulation if it fits your plan, cost awareness without cutting corners on security, and a long-term horizon resilient to cycle noise.

FAQ: 0.01 Bitcoin and the 2030 horizon

Q1: How much could 0.01 BTC be worth in 2030?

A: Based on projections of $645,119–$1,178,241 per BTC — estimate by independent researchers — 0.01 BTC could be $6,451–$11,782.

Q2: What is 0.01 BTC worth today?

A: With BTC near $109,376 (Sep 27, 2025), 0.01 BTC is about $1,093.76.

Q3: What factors most influence Bitcoin’s 2030 price?

A: Adoption via ETFs and institutions, regulatory clarity, macro liquidity, and programmed supply reductions after halvings.

Q4: Will Bitcoin necessarily hit $1,000,000 by 2030?

A: Not necessarily. It’s plausible in some scenarios — estimate by independent researchers — but not guaranteed.

Q5: Is 0.01 BTC a good starting goal?

A: For many, yes. It’s accessible, teaches the mechanics, and provides meaningful exposure if the thesis plays out. Ensure it fits your risk tolerance.

Q6: How do halvings affect long-term price?

A: They reduce new supply. If demand stays steady or rises, price pressure can build over cycles. The effect is indirect and varies by macro conditions.

Q7: What are the biggest risks to the bullish case?

A: Restrictive regulation, leverage-driven crashes, unfavorable macro backdrops, and energy policy headwinds.

Q8: Should I use an ETF or buy Bitcoin directly?

A: ETFs simplify access and reporting but charge management fees and keep you off-chain. Direct ownership allows self-custody and peer-to-peer transfers. Choose based on convenience, control, and costs.

Q9: How can I manage volatility when accumulating 0.01 BTC?

A: Use DCA, set allocation bands, and automate buys. Avoid using funds you’ll need within the next year.

Q10: How do I keep my 0.01 BTC secure?

A: If self-custodying, use a reputable hardware wallet, never expose your seed phrase, test small transactions, and store backups in separate safe locations.

Data sources and useful links:

CoinGecko BTC page,

Glassnode on-chain metrics,

Coinbase fees,

Kraken fees,

Bitstamp fees.

Not financial advice