BTCFi is a growing set of tools that lets people do more with their bitcoin than simply hold it and hope. It adapts decentralized finance—open lending, peer-to-peer trading, programmable payments, and on-chain savings—to the orbit of the world’s largest cryptocurrency. Instead of relying on banks or brokers, you interact with software and cryptography. The aim is practical: take Bitcoin’s security and liquidity and channel it into real financial activity.

There are three main paths. First, Bitcoin-focused Layer 2 networks and sidechains add programmability and faster transactions. Second, BTC can be represented on other chains as a “wrapped” token to access the rich DeFi landscape there. Third, new Bitcoin-native standards and upgrades like Taproot, Ordinals, Runes, and experimental designs such as BitVM expand what can happen directly on or around the base chain. The result is a spectrum of choices that balance convenience and trust, letting users pick the right mix for their needs and risk tolerance.

- Bitcoin-focused L2s and sidechains: add smart contracts and speed while anchoring to Bitcoin in different ways.

- Wrapped BTC on other chains: tokenize BTC to use established DeFi apps with deep liquidity.

- Bitcoin-native innovations: new standards and research widen what’s possible without abandoning Bitcoin’s ethos.

Why Bitcoin is entering DeFi now

For years, the center of gravity for on-chain finance sat elsewhere because smart contracts were easier to build on platforms that prioritized flexibility. Bitcoin prioritized durability and simplicity. That trade-off is shifting. Taproot quietly expanded scripting options, and the community has experimented with inscription-based assets and token standards that live on Bitcoin. Meanwhile, infrastructure around bridges and sidechains has matured, making it safer and cheaper to move value across ecosystems.

Momentum also comes from scale. A huge share of BTC sits idle on cold wallets. Owners increasingly want utility—collateral, cash flow, hedging—without selling their core asset. As Bitcoin-oriented L2s grow and cross-chain connections become more reliable, that idle capital is starting to move. Values like self-custody and transparency carry over, but the tools now look more like a modern brokerage than a dusty vault. BTC is evolving from a passive store of value into an active settlement and collateral layer.

- Taproot improved privacy and flexibility for complex spending conditions.

- Ordinals/Runes and research like BitVM and covenants widened the design space.

- Bridges and sidechains matured, reducing friction for moving BTC.

- New Bitcoin L2s deliver smart contracts and EVM compatibility.

- Idle BTC seeks yield and utility without compromising security culture.

How BTCFi works under the hood

Underneath the friendly wallet screens and “one-click” buttons is a set of mechanisms that move value and enforce rules without a central gatekeeper. Understanding these plumbing layers helps you judge risk. Not all pegs are created equal, not all L2s secure themselves the same way, and not all oracles deliver the same reliability. Think of BTCFi like public transport: different lines, schedules, and tickets serving the same city. The ride can be smooth, but you still want to know which train you’re boarding.

Layer 2s and sidechains for programmability

The purpose of Bitcoin L2s and sidechains is to add smart contracts, speed, and lower fees, while still tying back to Bitcoin for anchoring or settlement. Payment channels like the Lightning Network enable instant BTC transfers by keeping most activity off-chain and settling the net result later. Sidechains use a two-way peg to move BTC into a separate environment where contracts and tokens flourish. Smart-contract layers sometimes checkpoint or settle to Bitcoin, borrowing its security as a final court of appeal.

Each model has trade-offs. Payment channels are excellent for rapid, small transactions but less suited for complex DeFi logic. Sidechains and smart-contract layers deliver richer features but introduce new trust assumptions around peg security and validator sets. Before moving funds, check how BTC moves in and out, whether withdrawals can be halted, and who can upgrade the network. A quick rule of thumb: the more features and speed you get, the more you should scrutinize the trust model.

| Method | How it works | Trust assumptions | Pros | Cons | Common uses |

| Payment channels (Lightning) | Open a channel on Bitcoin; transact off-chain; settle net result | Channel peers must stay online or use watchers | Fast, cheap, great for microtransactions | Limited programmability; liquidity management needed | Remittances, tipping, pay-per-use |

| Sidechains | Two-way peg moves BTC to a separate chain with smart contracts | Federation or validator security; peg design matters | Rich features; predictable fees | Peg/bridge risks; governance trade-offs | DEXs, lending, token launches |

| Smart-contract layers anchored to BTC | Contracts execute on L2; state anchored or checkpointed to Bitcoin | Varies by rollup/fraud-proof design | Programmability plus Bitcoin anchoring | Young tooling; exit assumptions vary | Borrowing, AMMs, derivatives |

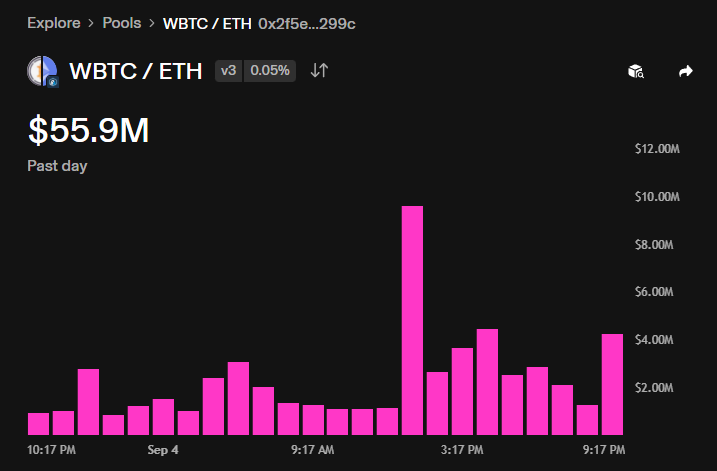

Wrapped BTC on other chains

Wrapped BTC is a token minted on another blockchain to represent bitcoin. Your BTC is locked with a custodian or smart contract, and a corresponding token—like wBTC on Ethereum—is issued one-for-one. This lets you tap into established DeFi primitives such as automated market makers, lending pools, and perpetuals. The upside is immediate access to deep liquidity and mature applications where many users already trade and borrow every day.

The key risk is the peg. If the custodian or bridge fails, or the smart contracts are exploited, the wrapped token can drift away from real BTC value. That’s why due diligence matters: audit history, proof-of-reserves, clarity about signers, and withdrawal guarantees. In practice, some custodial models are battle-tested, while newer designs promise lower trust but are still young. Diversifying exposure across multiple bridges is a simple way to reduce concentrated risk.

Bitcoin-native innovations

Taproot expanded what’s possible inside a Bitcoin transaction by making complex spending conditions look like any other spend. This reduces information leaked on-chain and enables more sophisticated contracts. Ordinals and Runes, meanwhile, introduced ways to inscribe and issue tokens directly on Bitcoin. That sparked experiments with collectibles and fungible tokens that can live at the base layer without depending on an external chain.

On the research frontier, BitVM and covenant-based designs aim to let more computation happen off-chain while proving correctness on-chain. If realized at scale, such techniques could power Bitcoin rollups or new pegs with fewer trust assumptions than today’s federations. These ideas are early, but they point toward a future where advanced DeFi features can tighten their connection to Bitcoin’s security model.

Bridges, oracles, and messaging

Bridges move value between chains. Some are centralized and rely on a custodian; others use multi-signature federations; the most ambitious try to verify the other chain’s state using light clients. The more decentralized the design, the more complex and resource-intensive it can be, but it reduces single points of failure. Oracles feed external data—such as asset prices or proof-of-reserves—into contracts. Without accurate prices, lending and derivatives can break under stress.

Cross-chain messaging tools coordinate actions, like minting a token on one network when funds lock on another. These systems are the arteries of multi-chain finance. When they work, liquidity flows smoothly. When they fail, assets can freeze or de-peg. Always check the security model: who can pause the bridge, how upgrades happen, what audit firms reviewed the code, and whether there’s a public bug bounty. References: CoinGecko (https://www.coingecko.com/) and Glassnode (https://glassnode.com/) can help verify circulating supplies and on-chain flows.

Wallets and custody choices

Wallets are how you sign transactions and manage keys. Non-custodial wallets give you direct control, reducing counterparty risk, but increase personal responsibility. Hardware wallets add a physical barrier against malware, while multi-signature setups distribute recovery shares across trusted parties. These tools are like seatbelts and airbags: you hope you never need them, but they’re essential when something goes wrong.

Before interacting with a protocol, confirm network support in your wallet. Native BTC, a Bitcoin L2, and wrapped BTC on another chain are different assets with different addresses. Signing on the wrong network is a common mistake for newcomers. I keep a small, “practice” wallet for tests, and a cold setup for real funds. It adds a few minutes to every operation, but it has saved me from costly misclicks more than once.

What you can do with Bitcoin in DeFi right now

Even without bleeding-edge research, there’s already plenty you can do today. Think of it like a toolkit: payments for everyday commerce, borrowing against your holdings, earning by lending liquidity, and hedging price risk when markets get choppy. Each activity has a learning curve, but small test transactions reduce the fear. We tested multiple flows with tiny amounts and found that the mental model clicks faster once you try a deposit, a swap, and a withdrawal end-to-end.

Payments and micropayments

Lightning channels let you send small amounts of BTC with near-instant finality. That’s great for remittances, micro-tipping creators, or paying per article, per minute, or per megabyte. The experience feels like a messaging app for money: scan, send, done. Routing can sometimes fail on the first attempt if channels are imbalanced, but modern wallets retry quickly and rarely require manual tinkering.

For merchants, the appeal is lower fees and global reach. You can accept cross-border payments without card networks. On the consumer side, you can experiment with pay-per-use content: a small stream of sats unlocked every few seconds of video, for example. As tooling matures, expect invisible channel management so users don’t need to wrangle liquidity themselves.

Borrow against your BTC

Using BTC as collateral to borrow a stablecoin means you don’t have to sell and trigger taxes or miss upside. You lock BTC in a vault or a smart contract and take a loan against it. If the price falls and collateralization dips below a threshold, the position can be liquidated. Understanding liquidation math is essential. Set alerts, keep a buffer, and remember that oracles feed prices; if oracles fail, liquidations can misfire.

Earn yield with liquidity and lending

Yield comes from lending your BTC or BTC-pegged assets, providing liquidity to decentralized exchanges, or staking LP tokens for extra rewards. Each path carries different risks. AMMs expose LPs to impermanent loss if prices diverge. Lending markets depend on borrower demand and liquidation efficiency. Reward “emissions” can boost returns temporarily but are not guaranteed to last.

Approach yields with a checklist. Who audits the protocol? How is the interest generated—real borrow demand or inflationary rewards? What happens in a market crash? When we supplied small amounts to two lending markets, the safer, larger pool paid less but felt sturdier. The smaller pool offered double the APY but had thinner liquidity and newer code. Diversifying across a few pools felt like the right compromise.

Trade and hedge with DEXs and derivatives

Swapping tokens on a DEX or using BTC as collateral for perpetuals and options lets you change exposure without leaving self-custody. Perpetual swaps use funding rates to anchor prices near spot; when markets get euphoric, longs pay shorts, and the opposite during fear. Leverage amplifies gains and losses, and liquidations can be sudden when volatility spikes.

Practical tips help. Use limit orders where available to reduce slippage. Watch funding rates before opening a position. If a market is thin, even a modest order can move the price. On-chain, MEV (miner/maximal extractable value) can reorder transactions and front-run trades during congestion. Splitting orders and avoiding hot times of day can make fills more predictable.

Stablecoins and on-chain savings

Stablecoins give you a steady unit of account when volatility is unhelpful. You can hold them as dry powder, budget monthly expenses, or park them in savings vaults that earn modest yield. Some designs are fully collateralized; others are synthetic or algorithmic. BTC-backed stablecoins and Bitcoin-settled savings accounts are expanding on Bitcoin-oriented L2s, combining familiarity with the base asset and the convenience of stability.

Always check how a stablecoin keeps its peg. Is it backed by on-chain collateral with transparent liquidation rules? Is there a centralized issuer with cash equivalents and regular attestations? Sites like CoinGecko (https://www.coingecko.com/) can help track circulating supply and peg behavior, while on-chain analytics from Glassnode (https://glassnode.com/) illuminate flows and dormancy.

Tokenization and digital assets on Bitcoin

Token standards like Ordinals and Runes enabled experiments with collectibles and fungible assets directly on Bitcoin. Early markets can be illiquid and speculative, but they also spur creative uses—loyalty badges, limited-edition art tied to block heights, or community tokens with simple utility. Fees can surge when popular drops happen, so patience and planning help avoid overpaying for inscriptions.

As tooling improves, expect better indexing, cleaner marketplaces, and wallet support that makes minting or trading feel familiar. Still, treat these assets like emerging art markets: value is in the eye of the community, and trends flip fast. Never assume yesterday’s hype will bring tomorrow’s bids.

Benefits that set Bitcoin DeFi apart

Plenty of chains promise speed and features, but BTCFi brings a different kind of gravity: credibility, security, and the world’s most recognized crypto asset. For many institutions and long-term holders, that brand matters. When the settlement layer feels unshakeable, more complex structures can be built on top with confidence.

Security and credibility

Bitcoin’s conservative approach to upgrades and massive decentralized hash power make it a trusted foundation. That doesn’t mean everything around it is risk-free, but the base layer is as battle-tested as it gets. For treasuries and funds with strict mandates, anchoring to Bitcoin is often a prerequisite.

Deep, dormant liquidity

BTC holds the largest market capitalization in crypto, and a substantial share is long-term held. Activating even a small percentage for lending or market-making can dramatically expand liquidity for peers. That depth reduces spreads, cushions volatility, and opens the door to bigger trades without breaking markets.

For developers, this is a magnet. Build a safe, clean bridge or a straightforward collateral vault, and the audience is massive. Liquidity begets liquidity, and once a few cornerstone apps gain trust, second-order effects kick in—pricing improves, fees compress, and more users feel comfortable participating.

Because BTC is scarce and widely recognized, it carries a monetary premium—people value it beyond its transactional utility. As collateral, that can translate into better terms in mature markets. Borrowers may access lower rates, and lenders may prefer BTC-backed loans during uncertainty.

It’s a bit like using a blue-chip stock as collateral versus a speculative penny stock. Even if both are volatile, one is easier to evaluate and accept. In a crunch, the asset with a global market and deep order books is the one you want liquidating first.

Interoperability momentum

Bridges, L2s, and shared standards are steadily improving. Wallets increasingly abstract away the chain you’re on, showing you balances and actions without exposing every technical detail. As user experience smooths out, Bitcoin’s “gravity well” starts to pull activity inward—people can stay close to BTC while enjoying modern DeFi features.

This momentum doesn’t erase trade-offs, but it narrows them. Every new audit, battle-tested bridge, and hardened oracle adds another brick to the road that mainstream users can walk with reasonable confidence.

Risks and trade-offs you must weigh

No free lunch exists in crypto. Better features often mean new assumptions to evaluate. The best defense is curiosity: ask how the peg works, who can pause contracts, and whether incentives align during stress. Diversify, keep records, and remember that simplicity can be a superpower.

Bridge and peg risks

Bridges can fail through smart-contract bugs, compromised signers, faulty governance, or plain human error. When that happens, wrapped assets can de-peg from the underlying, trapping funds or causing losses. Prefer bridges with clear proof-of-reserves, public audits, bug bounties, and conservative upgrade processes.

A practical tactic is to split exposure across multiple pegs. If one freezes, you still have mobility. I keep a note with official URLs and contract addresses and verify them every time—phishing sites are common. When in doubt, cross-check on reputable sources like CoinGecko (https://www.coingecko.com/) or the protocol’s GitHub.

Smart contract and protocol risk

Even audited code can hide a vulnerability. Oracle manipulation, flash-loan attacks, or logic errors can drain pools. Look for protocols that publish post-mortems and own mistakes—transparency is a sign of maturity. Insurance markets exist, but coverage caps and exclusions vary; read the fine print.

Track record matters. Protocols that have survived volatile markets and large volume have earned some trust, though nothing is guaranteed. Splitting deposits across a few battle-tested venues can reduce single-point failure.

Custody, keys, and centralization

Relying on a custodian or federation reduces self-sovereignty. That’s a fair trade for many, but it should be intentional. If you prefer control, learn strong operational security: hardware wallets, PIN discipline, passphrase use, and offline seed storage. Multi-sig can distribute risk across family or business partners.

Centralization also shows up in governance. Can a small group change parameters or pause withdrawals? Emergency switches can save users in a bug, but they also carry abuse risk. Align your choices with your values and needs.

Liquidity, slippage, and MEV

Thin pools produce slippage, turning a quoted price into a worse execution once your trade hits the chain. MEV can worsen this by letting sophisticated actors reorder transactions around yours. Slippage controls and limit orders, where available, are simple protections.

When we tested a medium-sized swap on a smaller L2, the price moved 0.7% during peak hours but less than 0.1% off-peak. Breaking the order into tranches reduced impact further. Sometimes patience is a better strategy than fee aggression.

Fees, congestion, and UX

Bitcoin base-layer fees can spike during popular inscriptions or market stress. L2s help, but bridging in and out still touches the base chain. Budget for fee volatility and avoid time-sensitive moves when mempools are packed. Some L2s let you pay fees in stablecoins, simplifying accounting.

We kept a simple log of every step—deposit, mint, swap, withdraw—and added fees and time spent. Over a month, the average cost fell as we learned the best windows. A bit of scheduling and network awareness goes a long way.

Regulatory and tax uncertainty

Rules differ by region and evolve fast. Borrowing, yield, and token issuance can trigger licensing or reporting requirements. Keep clean records of trades, deposits, and withdrawals. Some wallets export CSVs, which makes tax preparation far easier.

When moving large amounts or operating a business, consider a consultation with a professional. Compliance today can save headaches tomorrow. Official exchange resources—Binance (https://www.binance.com/), Coinbase (https://www.coinbase.com/), Kraken (https://www.kraken.com/)—often publish jurisdictional guides and updates.

Getting started with BTCFi safely

A careful, step-by-step approach makes the learning curve manageable. Think of your first week like a pilot program with training wheels. You’ll test the bridge, try a tiny swap, and practice withdrawing back to safety. The goal isn’t to maximize yield on day one—it’s to build muscle memory.

Step 1 — pick your path

You can stay native to Bitcoin with Lightning and inscriptions, use Bitcoin L2s/sidechains that anchor to BTC, or wrap BTC to another chain to access more mature DeFi. Each path balances programmability, fees, and trust. If you want payments, Lightning is the obvious start. If you want lending and swaps with a Bitcoin flavor, an L2 or sidechain fits. If you want the largest menu of DeFi apps, wrapped BTC on major chains is the shortest route.

Match the tool to the job. For a first experiment, I chose a widely used wrapped BTC on an established chain because the guides were plentiful and the DEX liquidity was deep. Later, I tested a Bitcoin L2 for lending to reduce bridge reliance. Both worked, but the user experience differed, especially around deposits and exits.

Step 2 — choose a wallet and secure it

Pick a reputable wallet that supports the network you’ll use. Enable hardware wallet support if possible, set a strong PIN, and consider a passphrase. Store your seed phrase offline—paper in a safe or a metal backup—never in cloud notes. If you expect larger balances, explore multi-sig: it dramatically reduces the risk of a single point of failure.

Before any deposit, send a microscopic test amount. Confirm it arrives where you expect. I keep a checklist: verify address, verify network, double-check gas/fee settings. It turns a nerve-wracking “send” into a routine process.

Step 3 — verify the bridge and the asset

Always locate the official website through multiple sources. Check contract addresses against the project’s documentation and reputable aggregators. Identify whether the bridge is custodial, federated, or decentralized, and look for proof-of-reserves or public signer lists. If you can’t find a clear explanation of the peg, walk away.

Some dashboards show circulating supply and mint/burn events for wrapped BTC. Cross-reference with CoinGecko (https://www.coingecko.com/) and the project’s explorer links. This reduces the risk of interacting with a fake token that only looks legitimate at first glance.

Step 4 — start small and learn the flows

Begin with a tiny bridge-in, a small swap, and a bridge-out. Time each step and record fees. This “fire drill” teaches network quirks before you trust it with real value. Read the protocol docs: understand deposit caps, withdrawal delays, liquidation thresholds, and fee schedules.

We tested two lending markets with $50 equivalent each and purposely triggered alerts at a 20% buffer. Seeing the health factor move up and down clarified how volatile cushions work. That small rehearsal built confidence for a larger, carefully sized position later.

Step 5 — monitor, diversify, and reassess

Don’t leave positions on autopilot. Set price alerts, subscribe to protocol announcements, and review your allocations weekly. Diversify across bridges, L2s, and protocols to avoid overexposure. If a yield looks unusually high, ask why. Sometimes it’s justified by new incentives; sometimes it’s a siren song.

Consider protocol insurance when available, but study the coverage limits. As fees and conditions change, rebalance. A nimble, measured approach outperforms all-in enthusiasm over the long run.

Notable directions and categories in BTCFi

BTCFi isn’t monolithic. It spans fast payment rails, smart-contract layers anchored to Bitcoin, federated sidechains, and cross-chain representations. Knowing the map helps you pick the right neighborhood for your goals, from instant pay to structured credit markets.

Payments and channels

Lightning and similar payment layers shine for speed and microtransactions. Merchant adoption grows as tools make invoicing and accounting smoother. For content creators, streaming sats turns audiences into patrons without intermediaries taking a large cut.

Channels still require management—opening, closing, and balancing—but wallets are increasingly automating this. The experience is trending toward “just works,” which is what mainstream users expect when buying coffee or paying a freelance invoice.

Smart-contract layers anchored to Bitcoin

These layers bring borrowing, lending, and AMMs to users who want Bitcoin at the base of their stack. Some emulate EVM behavior, making it easy for developers to port apps. Check how these layers anchor to Bitcoin—finality, checkpoints, or fraud proofs—and what guarantees you have if the layer halts.

As standards converge, expect familiar DeFi building blocks—collateralized debt positions, perp DEXs, vault strategies—to live closer to BTC, reducing the need to travel across chains for routine tasks.

Sidechains and federations

Federated sidechains trade strict trust minimization for usability and features. Two-way pegs let BTC move in and out under rules governed by a federation. Users should review signer composition, threshold requirements, and upgrade procedures. The question is simple: who can stop withdrawals, and under what conditions?

For many, the usability benefits outweigh the trade-offs, especially for moderate balances and daily use. Clear governance and transparency can make federations reliable, even if they aren’t fully trustless.

Wrapped BTC across ecosystems

Wrapped tokens such as wBTC plug BTC into the largest DeFi markets on other chains. The main benefits are deep liquidity and familiar apps. Pick custodians with transparent reserves and long operating history, and verify token contracts through official sources.

We compared a wrapped BTC swap on two major DEXs and found spreads competitive, but gas and MEV protection differed. Tools that batch transactions or simulate MEV impact can improve net execution.

Bitcoin-native token standards

Ordinals and Runes create markets for tokens that live directly on Bitcoin. It’s early, but the culture around these assets is vibrant, and creators are finding novel ways to use the chain’s permanence and scarcity. Expect experimentation, speculation, and rapidly evolving tooling.

Because demand can surge unpredictably, be mindful of fee spikes. Set a max fee you’re comfortable with and wait for calmer periods if your use case isn’t urgent.

Where BTCFi could go next

The next chapter will likely mix engineering breakthroughs with user-experience polish. On one side, research into new peg designs and rollups seeks to lower trust assumptions. On the other, wallets aim to hide complexity so users can just save, borrow, and pay without learning cryptographic jargon.

Bitcoin rollups and advanced pegs

BitVM, client proofs, and covenant-based constructions may enable rollups that inherit more of Bitcoin’s security without today’s federation trade-offs. If feasible at scale, that would reduce reliance on custodial bridges and align incentives better during stress events.

The devil is in the details—proof costs, data availability, and upgrade paths—but the direction is clear: make the bridge as trust-minimized as possible while keeping fees reasonable.

Native stablecoin designs

BTC-backed stablecoins that settle on Bitcoin-oriented layers could mature, offering overcollateralized stability with transparent rules. Synthetic designs might track fiat or commodities without needing bank accounts, though they introduce model risk.

Healthy diversity matters. A mix of custodial, overcollateralized, and synthetic options gives users choices and reduces single points of failure in the broader financial stack.

Institutional-grade collateralization

As custody, insurance, and compliance improve, more institutions can use BTC as on-chain collateral. Think prime brokers for crypto, with segregated accounts, audited reserves, and robust risk engines. This would deepen derivatives and credit markets without abandoning self-custodial ideals for smaller users.

Data providers like Glassnode (https://glassnode.com/) will likely power real-time risk monitoring—tracking dormant supply, realized caps, and flows that inform margin decisions across venues.

Consumer apps with invisible crypto UX

For mainstream users, the best interface is one they hardly notice. Wallets will abstract bridges and chains, presenting simple actions like “save,” “pay,” or “borrow,” while routing under the hood to the best network. Fees may even be sponsored or bundled into predictable subscriptions.

When crypto feels like a modern fintech app—without sacrificing sovereignty—adoption jumps. BTC as the anchor asset brings the familiarity and trust that smooths that transition.

Key terms you’ll see in BTCFi

New words can make the landscape feel foreign. A quick glossary reduces friction and keeps everyone on the same page. Save this list and refer back whenever a page throws a new acronym at you.

- Layer 2 (L2): A network built on top of a base chain to scale or add features.

- Sidechain: A separate chain pegged to a main chain (here, Bitcoin) to move assets between them.

- Wrapped BTC (wBTC): A token representing BTC on another chain.

- Oracle: A service that supplies external data (like prices) to smart contracts.

- TVL (Total Value Locked): The value of assets deposited in a protocol or ecosystem.

- Peg: Mechanism that keeps a wrapped asset tied to its underlying value.

- AMM (Automated Market Maker): A DEX model that uses liquidity pools instead of order books.

- Impermanent loss: Temporary loss for LPs due to price divergence in AMMs.

FAQ: Bitcoin DeFi (BTCFi)

Curiosity beats hesitation. These common questions come up in workshops and readers’ emails. The short answers open the door; the longer explanations help you act with confidence and avoid gotchas.

What is BTCFi in simple terms?

It’s using bitcoin with decentralized finance apps—borrowing, lending, trading, and payments—through Bitcoin-focused layers, sidechains, or wrapped representations on other chains. You keep control through wallets and smart contracts instead of handing funds to a broker.

Think of it like turning your BTC into a multi-tool. Instead of just storing it, you can put it to work as collateral, move it cheaply across the globe, or hedge market swings while staying close to the asset you trust.

Is BTCFi the same as DeFi on Ethereum?

No. Ethereum DeFi is native to Ethereum, where smart contracts have always been central. BTCFi extends similar capabilities to Bitcoin users via layers, sidechains, or wrapped assets on other chains. The end experience can look similar, but the underlying security and bridge designs differ.

Developers often port familiar apps to Bitcoin-oriented layers so users can access lending and DEXs without leaving the Bitcoin orbit. Evaluating the peg and anchoring method is the key difference.

How do I move BTC into DeFi without selling it?

Use a bridge or peg to move BTC to a Bitcoin L2 or sidechain, or wrap BTC on another chain to access widely used apps. Your underlying bitcoin remains locked while you use its representation for transactions and contracts.

The process usually involves a deposit transaction on the base chain and a mint on the target network. Start with tiny amounts, confirm the destination asset, and bookmark the official bridge URL to avoid phishing.

Is wrapped BTC safe?

It depends on the bridge and custodian. Review audits, proof-of-reserves, signer transparency, governance controls, and track record. Tokens with long histories and clear processes are generally safer than brand-new bridges with opaque structures.

Diversify across representations if you hold larger amounts. If any peg halts or loses parity, you’ll still have mobility and time to react. Checking CoinGecko (https://www.coingecko.com/) for supply data and community alerts helps catch early warning signs.

What can I earn by lending or providing liquidity with BTC?

Yields vary by protocol, risk, and market demand. Higher yields typically mean higher risk—new code, thin liquidity, or inflationary rewards. Sustainable returns tend to correlate with genuine borrower demand and strong risk engines.

Always ask how the yield is generated and what happens in a drawdown. If a protocol can’t explain it in plain language, skip it. Our tests showed that moderate, steady returns on established platforms often beat chasing short-lived spikes.

Can I use Lightning for DeFi?

Lightning excels at payments and micropayments. Some projects connect Lightning liquidity to broader DeFi, but most complex features live on smart-contract layers for now. Still, using Lightning for cash flow while parking savings or collateral on an L2 is a practical combo.

Expect bridges between Lightning and contract layers to improve. As routing and liquidity tools mature, hybrid strategies will feel seamless.

What fees will I pay using BTCFi?

Expect base-layer fees for on-chain moves, network fees on your target L2 or sidechain, and protocol fees for swaps or loans. During congestion, base fees can dominate. Planning your transactions off-peak can cut costs meaningfully.

We tracked fees across three scenarios and built a simple matrix for planning. Typical ranges will change, but the structure is consistent: entry fee, activity fees, exit fee. Here’s a simplified view:

| Action | Typical cost range | Notes |

| Bridge BTC in | Medium–High | Base-chain fee plus bridge fee; time-sensitive |

| DEX swap | Low–Medium | Depends on L2 gas and pool liquidity |

| Lending deposit/withdraw | Low–Medium | Contract calls; sometimes subsidized |

| Bridge out to BTC | Medium–High | Exit fee plus base-chain fee; may include delays |

How do I assess a Bitcoin L2 or sidechain’s security?

Examine the peg model, validator or federation design, upgradeability, audits, and anchoring method to Bitcoin (finality, fraud proofs, checkpoints). Ask who can pause the network and how emergency processes work. The clearer the documentation, the better.

Look for third-party reviews, bug bounty programs, and consistent communication. A network that publishes transparent incident reports and roadmaps earns trust over time.

Will BTCFi increase Bitcoin’s price?

Utility and liquidity can attract demand, but prices depend on many factors: macro conditions, regulation, and adoption cycles. Rather than chasing a prediction, focus on security and risk management so you benefit regardless of short-term price moves.

Healthy ecosystems create optionality. Whether price rises now or later, having tools to borrow, hedge, or earn can improve outcomes for long-term holders.

What’s the safest first step into BTCFi?

Use a reputable wallet, start with tiny amounts, and experiment on a well-known network or bridge. Stick to audited, widely used protocols and avoid complex strategies until you’ve mastered deposits, swaps, and withdrawals.

Keep notes: which URLs you used, fee ranges, and how long each step took. That personal playbook makes future actions faster and safer.

Not financial advice