Ask ten people to picture Bitcoin and you’ll get ten versions of the same idea: a shiny coin with a tilted B, or a QR code flashing on a phone, or a block explorer page full of numbers. The truth hides in plain sight. Bitcoin has no body, no metal, no paper. It lives as verifiable records on a public ledger, and what we “see” are symbols, addresses, and transactions that map to money controlled by cryptographic keys. This guide walks through what’s real, what’s representational, and how to recognize legitimate cues in 2025—plus safe ways to hold, pay, and even gift it.

The image most people recognize: the ₿ symbol and orange logo

There’s a reason your mind jumps to an orange circle with a tilted B. The symbol ₿ (Unicode U+20BF) is the currency sign associated with Bitcoin, and over the years, the community embraced a bright orange palette as a quick visual cue in apps, wallet icons, price tickers, and news graphics. You’ll also see tickers like BTC and XBT on charts and exchange interfaces; they point to the same asset.

Unlike official fiat currency symbols set by governments, Bitcoin’s identity grew from grassroots adoption. Designers iterated on the “B with double vertical strokes” motif until the clean, modern look became a de facto standard. It’s not enforced by any central authority; it’s simply what people chose to recognize. If you’re scanning apps or payment screens, this color-and-symbol combo helps you separate Bitcoin from lookalike tokens.

For accuracy’s sake, remember this emblem is a signpost, not the thing itself. The digital value is always on the blockchain, not in the logo, not on a sticker, and not inside a gold-plated souvenir. Still, the symbol has cultural force—storefronts use it to say “we take BTC,” just as card logos signal accepted payments.

What Bitcoin actually is: entries on a public ledger

Strip away the artwork and you find a straightforward accounting system. Bitcoin keeps track of value using unspent transaction outputs (UTXOs). Think of each UTXO as a sealed envelope holding a specific amount of BTC. When you pay, your wallet selects one or more envelopes you control, opens them with your private key, and creates new envelopes for the recipient and your change. The network of nodes checks the math and the signatures, then miners package valid transactions into blocks.

That’s the real “look” of Bitcoin: auditable entries in an append-only database replicated across thousands of nodes. You can inspect data—inputs, outputs, fees, and confirmations—without asking permission. Sites like block explorers provide a window into this ledger, while analytics platforms such as Glassnode offer aggregated views of on-chain trends and network activity.

Prices, meanwhile, are discovered in open markets. If you want a quick snapshot of spot price and trading activity across markets, CoinGecko aggregates quotes from major exchanges and is a helpful bookmark for both beginners and pros tracking movements throughout the day.

How you see Bitcoin in everyday apps

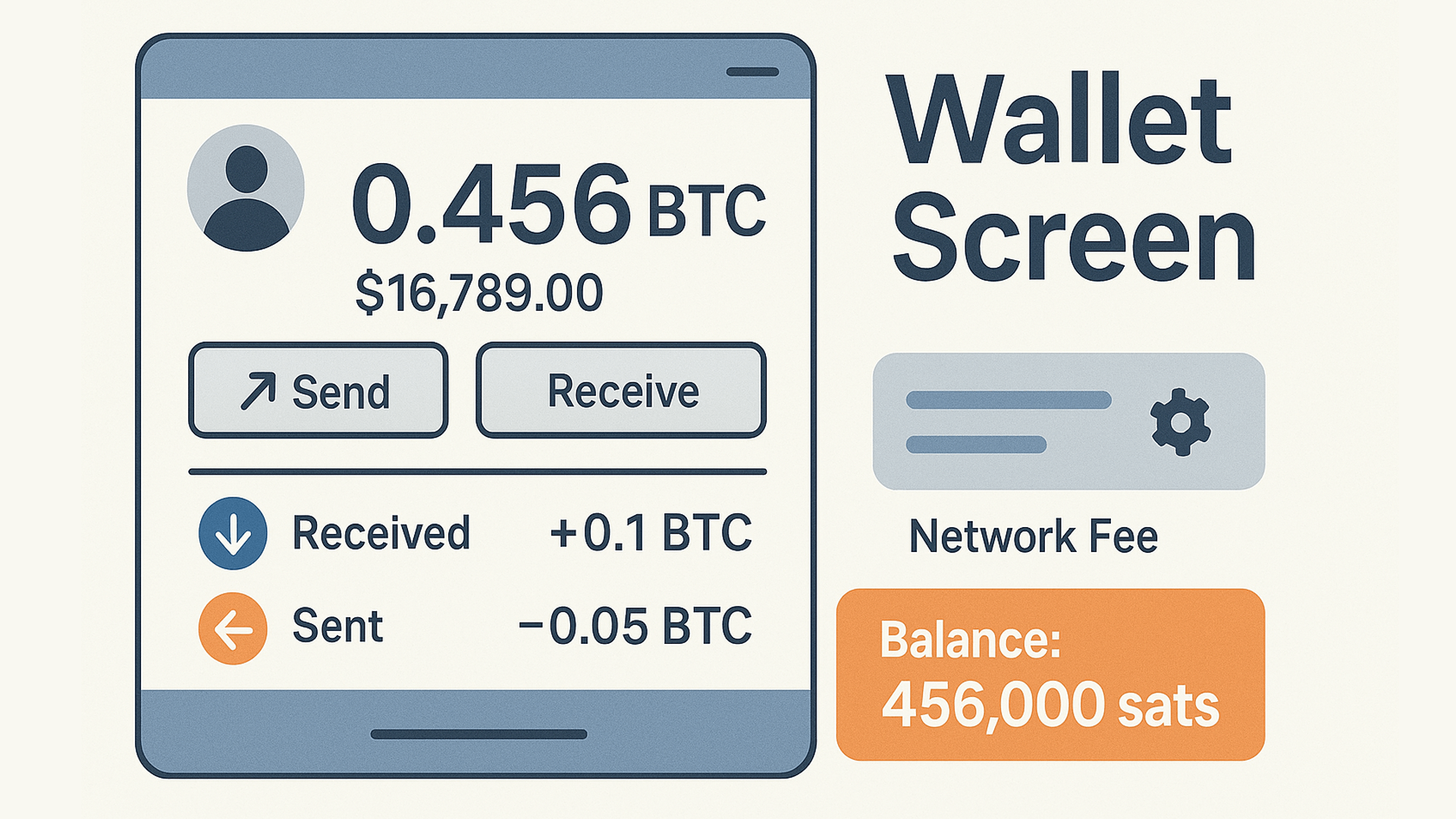

Most people encounter Bitcoin through wallet and exchange apps that smooth over the complexity. You’ll see a balance, a list of incoming and outgoing transactions, and a big button that says Send or Receive. Underneath, the app is managing keys and UTXOs and creating properly signed transactions on your behalf.

Wallet screens and balances

Your balance is a sum of spendable UTXOs the wallet has discovered for your addresses. Good wallets show both BTC and your local currency equivalent so you can gauge value quickly. Some will display small units called satoshis (“sats”) for precision—1 BTC equals 100,000,000 sats—useful when paying tiny amounts, such as Lightning tips or micro-purchases.

We tested several mainstream apps and found that the most helpful screens share common traits: clear incoming/outgoing labels, a visible network fee estimate, and easy access to the transaction ID (TXID). When an app exposes coin control or labels, more advanced users can manage privacy and accounting without switching tools.

Addresses you’ll recognize

Addresses are the destinations for payments, like email addresses for money. They come in several formats—this is normal, and each version reflects upgrades over time. Here are the ones you’ll see most:

- Legacy (P2PKH): starts with 1 (example pattern: 1A1zP1eP…). Older but still valid.

- P2SH: starts with 3. Often used for multisig or wrapped scripts.

- Bech32 (SegWit): starts with bc1q. Modern, efficient, lower-fee potential.

- Taproot (Bech32m): starts with bc1p. Newer scripts, better privacy features.

Always use copy/paste or scan a QR code. Address typos won’t bounce back like an email—they can result in permanent loss. Many wallets validate address checksums to reduce mistakes; if your app flags an address as invalid, stop and re-check the source.

QR codes and payment requests

QR codes reduce human error. A scannable request often includes a BIP21 URI, bundling the address, amount, and an optional label or note so the receiver knows what the payment is for. You’ll also see QR-style strings for Lightning invoices and LNURLs that encode fast off-chain payments.

When we compared QR workflows across popular wallets, the cleanest setups pre-fill the amount and memo and confirm the network (on-chain vs. Lightning) before you hit Send. That one extra confirmation screen catches most mistakes in busy, real-world situations.

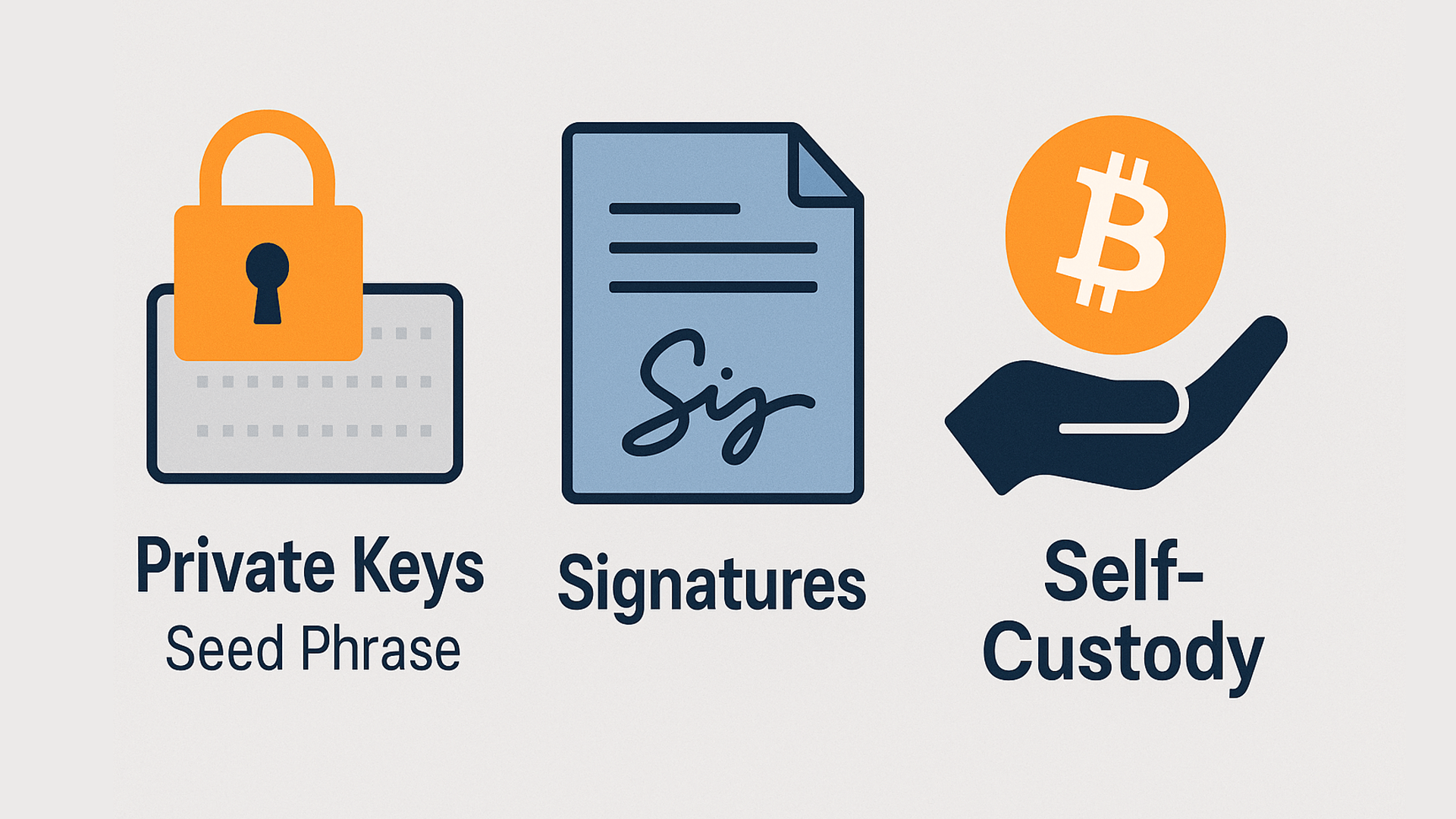

Proof of ownership: keys, seeds, and signatures

Ownership is not about a name on a server or an email confirmation. It’s about controlling private keys that can produce valid signatures. If your key can authorize spending from a given address, the network accepts that you control the funds. Nothing else counts as proof.

Private keys and seed phrases

A private key is a secret number. Most wallets present it to you as a 12- or 24-word recovery phrase (BIP39), which can regenerate all your accounts. Guard it like a master password. If anyone else gets it, they can move your coins—and there’s no helpline to reverse the action.

For long-term resilience, people store seeds on paper or stainless steel to resist water and fire. A safe practice is to keep multiple copies in different secure locations. Advanced users sometimes use Shamir backups or multisignature wallets to avoid a single point of failure.

Signatures, not screenshots

To spend, your wallet signs a transaction with your private key. Nodes verify the signature with the matching public key. Screenshots of balances, emails, and photos of coins prove nothing; only a valid on-chain transaction or a settled Lightning payment shows the money really moved.

If someone claims “payment sent,” ask for the TXID and check it yourself. Lightning receipts settle instantly, but most apps will still display a payment hash or invoice ID you can verify inside the wallet or with compatible tools.

Self-custody versus custodial accounts

Self-custody means you hold the keys, typically with a hardware or software wallet. It maximizes sovereignty and reduces counterparty risk. Custodial accounts—on exchanges or fintech apps—hold keys on your behalf and credit your balance in a database. Convenient, but you trade cryptographic control for a company promise.

- Self-custody: pro—true control, no withdrawal gatekeepers; con—responsibility for backups and security.

- Custodial: pro—easy onboarding, recovery via company support; con—account freezes or outages can block access.

Physical bitcoins that really held BTC: a short history

In the early days, creators minted metal tokens with holograms concealing private keys. The idea was simple: the coin is a bearer instrument. If the hologram is intact and the corresponding address still holds funds, you can treat the coin like cash. Peel the hologram to redeem the value. Notable examples include Casascius coins produced in denominations from fractions of a BTC to 1,000 BTC. Coverage in outlets such as BitcoinNews and explainers like Webopedia chronicle this short, colorful chapter.

Casascius and other loaded coins (2011–2013)

Casascius coins became the most famous because their build quality, denominational variety, and transparent address lists made them easy to verify. Each piece mapped to a public address whose balance anyone could check. Collectors prized the elegance: hold a coin, hold the BTC.

Over time, loaded pieces gained numismatic value beyond their face amount. Rarity, condition, intact seals, and provenance all matter for pricing. Premiums over face value can be substantial—estimate by independent researchers—especially for early editions and high denominations.

Why production largely stopped

By 2013, U.S. regulators considered selling pre-loaded coins akin to money transmission. The compliance burden halted mainstream creation of funded pieces. While hobbyist efforts sporadically continued, the golden era of loaded metal tokens faded. The original coins transitioned from payment instrument to collectible artifact.

Modern commemorative coins are plentiful, but they almost never contain live value. They’re souvenirs and conversation starters. If someone offers a “pre-loaded coin,” healthy skepticism is warranted until you can verify an address and a seal.

Verifying a loaded coin without peeling

Every legitimate loaded coin has a linked public address. You can paste it into any reputable block explorer and check the balance and history. If the balance is intact and the hologram seal is unbroken, the collectible still functions as a bearer instrument.

Peeling the hologram exposes the private key so you can sweep funds safely into your own wallet. Once peeled, the numismatic premium usually drops sharply because the coin is no longer a sealed bearer item—estimate by independent researchers.

Modern physical representations: collectibles and bearer devices

Even without classic loaded coins, there are ways to put Bitcoin in your hand—symbolically and functionally. Decorative pieces serve as mementos. Specialized hardware can act like cash, preserving the idea of a transferable bearer instrument without exposing keys prematurely.

Souvenir coins with no on-chain value

Browse web stores and you’ll find gold-colored tokens and novelty items bearing the ₿ symbol. They’re art. They don’t store funds unless paired with a verifiable address and a sealed key (rare today). They make fine gifts, especially for beginners, but do not assume they carry monetary value.

- Pros: affordable, great for teaching and conversation, visually appealing.

- Cons: can be mistaken for real value, used by scammers to imply “loaded” status.

Bearer devices: the new way to “hold it in your hand”

Devices like OpenDime and Satscard reintroduce the bearer concept with modern security. You load BTC to the device’s address and hand the device to someone else. Until a physical action reveals the key (e.g., breaking a seal or performing an NFC tap sequence), nobody—including you—can spend the funds. That makes them useful for gifts, tips, or offline transfers.

We tested a small handoff: loaded a device with 100,000 sats, met a friend at a cafe, and transferred it like a banknote. They verified the address balance on a phone. Later, they “unsealed” it and swept funds into their wallet. The experience felt tangible yet remained anchored to verifiable on-chain data.

- Pros: cash-like transfer, privacy for small amounts, simple UX for recipients.

- Cons: physical theft risk, limited denominations, long-term storage depends on device durability and vendor longevity.

Paper wallets: once popular, now risky

Printing a key and address on paper sounds simple, but secure generation is tricky. Insecure websites, compromised printers, or a single photo can leak your funds. Recovery friction is high, and many old paper wallets were drained by attackers waiting patiently for mistakes.

Best practice in 2025: use a reputable hardware wallet for cold storage or a specialized bearer device for physical transfers. Paper belongs in backups, not in primary storage.

What a legitimate Bitcoin transaction looks like

Legitimate payments leave a trail you can verify. On-chain, that’s a TXID you can paste into a block explorer. For Lightning, that’s an invoice that resolves to “paid” in your wallet or a receipt showing settled status. Either way, you don’t need to trust a screenshot.

Key elements you can check

- TXID: unique hash for the transaction.

- Inputs/outputs: which addresses sent and received, including change outputs.

- Fee and feerate: paid to miners; too low can delay, too high wastes money.

- Confirmations: number of blocks since inclusion. 1–3 confirmations often suffice for everyday payments; larger transfers typically wait for 6+.

Example calculation: Suppose your wallet builds a 140 vB SegWit transaction at 15 sat/vB. Fee = 140 × 15 = 2,100 sats. If BTC trades at $60,000 (example; check CoinGecko for live price), that’s about $1.26. If the mempool is busy, your wallet might suggest 25–40 sat/vB to confirm in the next block—estimate by independent researchers.

Reading it on a block explorer

Paste the TXID or address into a known explorer. You’ll see the timestamp, block height, inputs, outputs, and confirmations. Some explorers annotate transactions with tags or risk signals; use those as hints, not gospel, and cross-check with multiple sources if something looks odd.

| Field | What it shows | Why it matters |

| TXID | Unique hash of your transaction | Lets anyone verify inclusion in a block |

| Block height | Which block confirmed it | Strength of finality grows with height |

| Inputs/outputs | Spending sources and recipients | Confirms the right address and amount |

| Fee/feerate | Total and sats per vB | Explains delays or costs |

| Confirmations | Blocks mined on top | Higher count equals higher security |

Red flags and common scams

- “Here’s a screenshot of payment.” Not proof. Ask for a TXID or settled Lightning receipt.

- “Physical coin preloaded, no address.” Insist on the public address and verify the on-chain balance.

- “Guaranteed returns.” Bitcoin has no native yield. If you see fixed daily interest, assume high risk or fraud.

- Fake explorers or phishing domains. Bookmark reputable explorers; type URLs carefully.

Misconceptions marketers love to spread

Creative visuals are great for education, but they can blur reality. A logo stamped on metal doesn’t become money, and jargon about “minted bitcoins” often misleads newcomers about how issuance works.

“Minted bitcoins” as if they were metal coins

Mining mints blocks and enforces rules. It discovers valid hashes, assembles transactions, and issues new BTC per the schedule. No physical minting happens. Miners compete in computation, not metallurgy.

“Gold-plated bitcoins” equal real value

A gold-plated token with a Bitcoin logo is art. Value resides where private keys can spend UTXOs on the blockchain. If an item claims to be “backed by BTC,” you should be able to verify an address and a balance. Without that, it’s a souvenir—nothing more.

Safe ways to hold and gift Bitcoin in 2025

Your approach depends on purpose. Long-term savings need robust backups and minimal attack surface. Everyday spending favors convenience, small balances, and fast settlement. Gifting requires clarity so the recipient can redeem safely.

Hardware wallets for long-term storage

Reputable hardware wallets keep your keys offline and sign transactions securely. Store the recovery phrase on paper or steel, offline. For larger holdings, consider multisignature setups requiring two or three devices to move funds; this reduces single-device risk at the cost of complexity.

- Pros: strong isolation, mature UX, wide ecosystem support.

- Cons: upfront cost, learning curve, responsibility for backups.

Personal note: I compared the fee friction of self-custody versus keeping coins on an exchange “until I need them.” Paying one fair withdrawal fee up front cost less—and reduced counterparty risk—than leaving funds on a platform that could later change terms or throttle withdrawals.

Lightning for everyday spending

The Lightning Network enables fast, low-fee payments for small amounts. In apps, Lightning “looks like” invoices—bech32-style strings—or NFC tap-to-pay. It shines for coffee-size purchases and tipping. Custodial Lightning wallets get you started in minutes; self-custodial options offer more sovereignty once you learn channel management.

We tested a small setup: load 50,000 sats into a self-custodial Lightning wallet, pay three invoices, and receive two tips. Total routing fees were a few sats—pennies at most—with instant settlement. While exact costs vary, the experiential difference from on-chain for micro-amounts is dramatic.

Gifting sats safely

- Send to a new address in the recipient’s wallet; confirm with a tiny test first.

- Use a reputable voucher or gift-code service that redeems directly into the recipient’s self-custody wallet.

- For in-person handoffs, consider a sealed bearer device and include printed instructions for redemption.

Visual cues that are legitimate today

Because Bitcoin is intangible, reliable visual cues matter. Focus on Unicode symbols, modern address formats, and platform interfaces that expose TXIDs and confirmations. If something looks off, pause and verify.

Symbols and tickers

- Currency sign: ₿ (Unicode U+20BF).

- Tickers: BTC and XBT both refer to Bitcoin on markets and charts.

- Units: sats = satoshis, the smallest units. Many apps let you switch display units.

Modern address formats and QR codes

Bech32 (bc1q…) and Taproot (bc1p…) addresses are now common. They’re case-insensitive and QR-friendly. If a QR decodes to something unexpected—a URL instead of a BIP21 URI—slow down and double-check.

Here’s a quick comparison you can keep handy:

| Address type | Prefix | Typical use | Notes |

| Legacy (P2PKH) | 1… | Older wallets | Widest compatibility, higher bytes per input |

| P2SH | 3… | Multisig, wrapped scripts | Transitional format |

| Bech32 (SegWit) | bc1q… | Modern standard | Lower fees, better error detection |

| Taproot (Bech32m) | bc1p… | Enhanced scripts | Future-friendly, improved privacy properties |

Exchange UIs that matter

Legit platforms provide clear deposit addresses, transparent withdrawal fees, and TXIDs you can track. For base spot trading fees, current public schedules from major exchanges are a helpful benchmark. Always check the official fee pages before trading or withdrawing, as tiers, promos, and VIP levels can change.

| Exchange | Base spot trading fees | What we like | Check fees |

| Binance | Typically 0.10% maker/0.10% taker at base tier | Deep liquidity, broad markets | Official fee page |

| Kraken | Typically 0.16% maker/0.26% taker at entry tier | Clear UI, strong security track record | Official fee page |

| Coinbase Advanced | Approximately 0.00%–0.60% depending on volume | Beginner-friendly onramp, regulated | Official fee page |

Where the look and feel of Bitcoin is heading

Designers are making the surface simpler while keeping the cryptography rock solid underneath. Expect more human-readable features, fewer sharp edges for beginners, and smoother cross-compatibility across wallets and layers.

Wallet UX trends

Seed handling is evolving. Some products offer encrypted backups to secure elements or social recovery flows so newcomers aren’t scared by 24 words. NFC tap-to-pay and contact labels reduce friction without sacrificing control. According to analysts’ estimates, adoption of seedless recovery flows will grow as hardware and mobile secure enclaves mature.

Smarter privacy and labels

Wallets increasingly ship with tools that help avoid address reuse, surface coin control, and annotate counterparties for personal accounting. Expect default privacy to improve—without exposing users to complexity—through better labeling, PayJoin support, and automatic batching where appropriate.

Layers that feel instant

Lightning continues to push toward card-like experiences: scan, tap, done. Newer protocols and liquidity-management tools aim to abstract away channels and routing while keeping users in self-custody. According to analysts’ estimates, the share of small-value Bitcoin payments routed via Lightning will keep rising as merchant tooling and POS integrations mature.

FAQ

Q1: What does a real Bitcoin look like in person? A: It has no physical form. You’ll encounter the ₿ symbol, addresses, QR codes, and app balances. On-chain, Bitcoin appears as verifiable entries in a public ledger.

Q2: Are physical bitcoins still made? A: Funded metal coins like Casascius largely stopped around 2013 due to regulation. Modern items are usually souvenirs or specialized bearer devices, not minted coins.

Q3: How can I tell if a “physical bitcoin” holds real BTC? A: Ask for the public address tied to the item and check its balance on a block explorer. An intact seal plus a funded address signals it’s still loaded.

Q4: What’s the Bitcoin symbol on keyboards? A: The currency sign is ₿ (Unicode U+20BF). If your keyboard lacks it, use the ticker BTC.

Q5: What do legit Bitcoin addresses look like? A: Common prefixes are 1, 3, bc1q, and bc1p. Copy/paste or scan QR codes to avoid typos.

Q6: How do I verify a Bitcoin payment? A: Request the TXID and check it on a reputable explorer. Confirm the recipient address, amount, and confirmations.

Q7: Are screenshots proof of payment? A: No. Only an on-chain confirmation or a settled Lightning payment proves transfer.

Q8: Is a paper wallet a good idea in 2025? A: Generally no. Secure generation and handling are hard. Prefer hardware wallets or vetted bearer devices.

Q9: What’s the safest way to store Bitcoin long term? A: Self-custody with a hardware wallet, offline seed storage, and optionally multisig for larger holdings.

Q10: Can I gift Bitcoin physically? A: Yes. Use a sealed bearer device, a redeemable voucher, or send to a new address in the recipient’s wallet with clear instructions.

Further reading and verification:

Disclaimer: Not financial advice